For folks who possessed a house anywhere between 2006 and you may 2011, there’s a high probability which you noticed your own residence’s value sour out of the-big date levels to any or all-big date lows. Inside 2012 by yourself, quick conversion taken into account twenty-two % of all of the domestic deals.

What exactly is a preliminary deals?

A primary marketing is the revenue from a house where the newest proceeds try not enough to repay all the financial balance contrary to the assets.

If there’s multiple lienholder towards the assets, a first and a second mortgage, such, it’s important that every lienholders agree to undertake below the total amount due since percentage-in-complete.

Brief deals wishing symptoms depend upon the type of mortgage you search. In general, government-supported mortgage loans be more forgiving than just traditional financial guidance.

Although not, you can find low-primary programs that may agree you 1 day regarding foreclosure if one makes a substantial downpayment and you will pay a top financial speed.

Non-QM mortgage just after a preliminary revenue

Borrowing from the bank being qualified conditions to have non-QM fund vary, but some lenders bring low-QM finance just one day out regarding an initial sales.

Very low-QM loan software carry higher rates of interest and want big down money. Talk to a low-QM home loan company on qualification criteria.

FHA: Zero prepared several months

FHA lets homebuyers to apply for a home loan just after an effective short profit. It is essential to notice, however, that FHA’s zero prepared months possess several rigid caveats.

- You’re perhaps not for the standard for the prior home loan at the period of the short sales, and you can

- About 12 months before the brief marketing, you have made the home loan repayments punctually.

Should your mortgage was a student in standard during the time of brand new quick deals, FHA need a great three-year wishing months before applying to have a unique mortgage.

FHA financial immediately after a preliminary selling

- The new big date of the quick selling, Otherwise

- If your earlier home loan was also a keen FHA-insured loan, regarding the date that FHA paid the latest claim to your quick profit.

If you can tell you extenuating products was the cause of financial default, you are in a position to be considered sooner than the three-year months.

- Divorce or separation (sometimes)

- Serious infection otherwise loss of a member of family, constantly amongst the top salary earner, or

- Occupations loss, again usually involving the number one wage earner

Conforming financing after a primary revenue

Homebuyers trying set below 10 % off will require to go to eight years regarding the day of the quick deals.

Discover exclusions into regular waiting episodes to possess a conventional financing. To be eligible for this type of exclusions, you would like the absolute minimum advance payment out-of 10 %, and you may authored research your small profit try caused by extenuating issues.

While not constantly because damaging given that a property foreclosure, a preliminary business will get hurt the credit. This will depend on which you negotiate together with your lender. Certain doesn’t declaration they in the event your citizen tends to make partial restitution to fund a number of the lender’s losses.

In case the quick purchases are claimed because the a significant delinquency otherwise derogatory goods, it can stay on your own checklist for up to 7 many years.

Tune your own borrowing

Brief sales usually show up on your credit history because the Paid/finalized with no harmony. There’ll even be brand new notation, compensated for under full harmony.

Often financial institutions make this incorrect and you can declaration small conversion process inaccurately. Its imperative that your particular brief sale is reporting toward credit agencies precisely.

Rebuild your borrowing

Fixing the borrowing concerns opening the fresh new credit account and you can expenses them punctually for at least one year. Keep most of the accounts open and you may outlay cash in full per month.

Protected playing cards is going to be a beneficial replacement for conventional borrowing cards. Choose one carefully, even if. Particular just collect steep charge and supply absolutely nothing work with. Covered cards merely reconstruct borrowing from the bank if they statement their records so you can credit agencies.

You’ll be able to change your credit rating since a keen signed up user. This payday loan Milliken means you have family otherwise household members that have expert that are willing to put that the profile due to the fact a third party representative.

Understand your credit rating

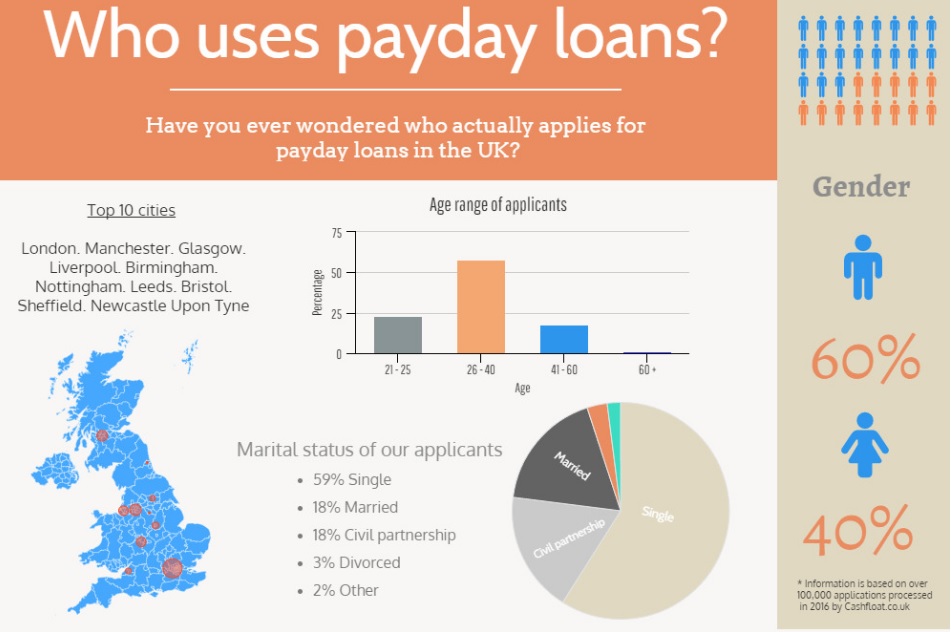

Predicated on a current questionnaire, 40 % out of consumers don’t understand the significance of borrowing from the bank results in making borrowing from the bank behavior.

There are certain circumstances that make up your own credit scores, particularly commission background, age profile, types of levels and you can number of borrowing concerns.

Just what are The present Home loan Costs?

Regardless of if you have had an initial sales on your own recent past, you might still be eligible for a minimal down payment, a reduced rate, and a decreased monthly homeloan payment.

Learn latest mortgage rates today. Zero public defense number is required to start, and all sorts of estimates come with accessibility your alive financial borrowing results.