In the event your provide financing are in your account to have a good month or two, you will possibly not be required to offer a present page. Morsa Pictures/Getty Photos

- So why do I want a present page?

- Home loan company requirements

- What you should include in a present page

User hyperlinks into the activities in this post americash loans Millport are from people you to make up united states (select all of our marketer revelation with our list of couples to get more details). But not, all of our feedback was our very own. Observe we rate mortgages to enter unbiased recommendations.

- Lenders you prefer documentation for high deposits on your own checking account. To possess skilled funds, this means providing something special letter.

- Something special page will include title and contact guidance off the new donor and a statement that zero repayment is expected.

- That allowed to gift you funds having a deposit and you may exactly how much they can offer utilizes your loan method of and you will how property you are to invest in try categorized.

Protecting sufficient having an advance payment is often the biggest difficulty first-date homebuyers face. To get over which, of numerous check out family unit members to assist them to fill the brand new pit ranging from what they need and what they have protected.

When you look at the 2019, 32% regarding earliest-time homeowners acquired something special or mortgage of a relative or buddy with the the downpayment, considering good 2020 declaration throughout the Federal Relationship out of Realtors.

For the majority of particular mortgages, you may be permitted to fool around with current money in order to origin your own down payment. You simply need a bit of files – specifically, a down-payment gift page – to really make it occurs.

Home financing current letter try a statement published by the individual just who skilled you the funds you to verifies the money is a gift and this repayment is not expected. The fresh new present letter should contain information regarding the fresh new provide donor and you will their relationship to the newest individual.

Mortgage lender conditions

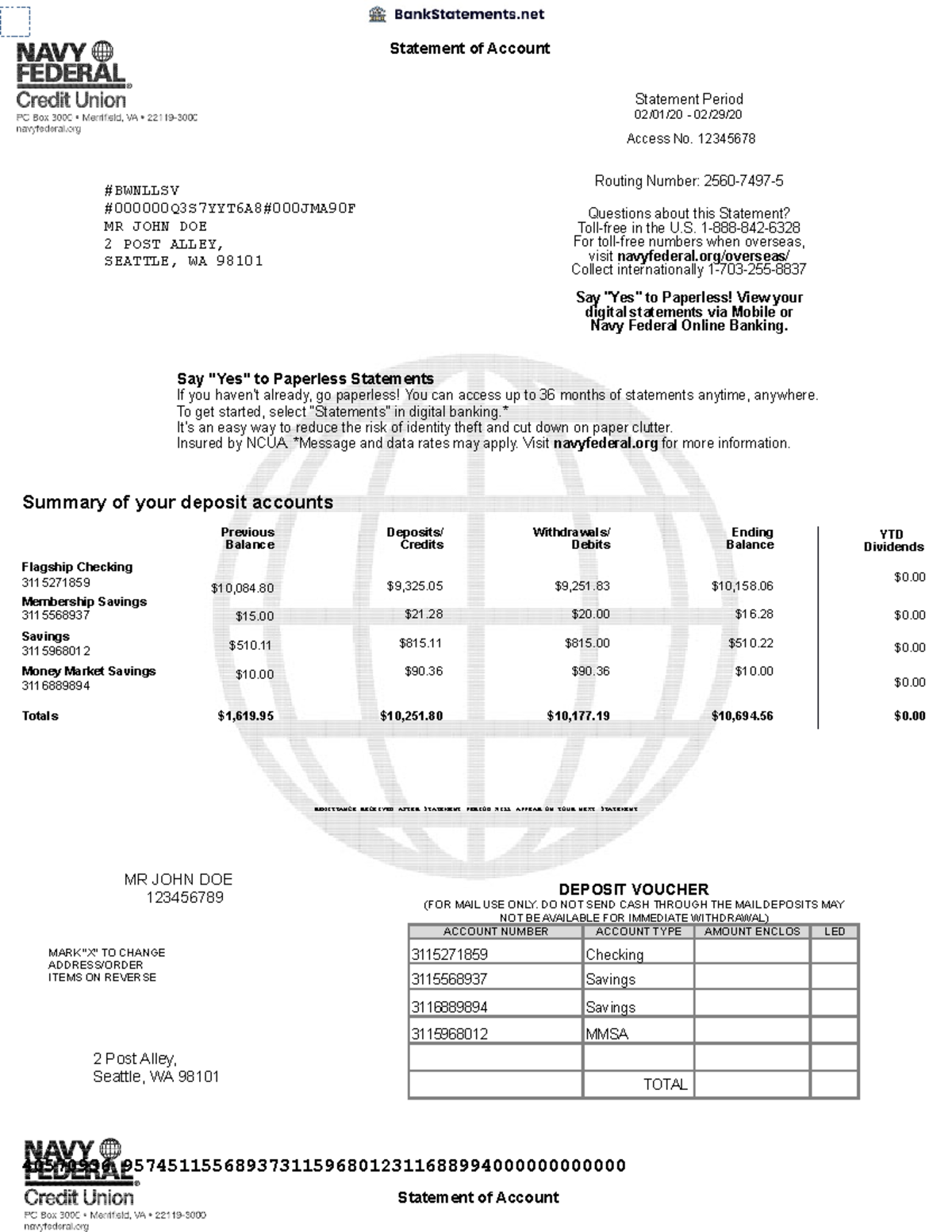

When you sign up for a mortgage, lenders scour your financial advice to make certain there is the financing and then make their down-payment and that you feel the earnings to cover your monthly payments. As part of this step, it is possible to fundamentally offer their bank with a couple months’ worth of financial statements.

When it observes one large, out-of-the-ordinary places in the checking account, it’s going to need to know where that cash originated from. Loan providers accomplish that to make sure that:

- You aren’t playing with that loan to suit your down payment.

- The money was away from a reasonable, non-deceptive resource.

«The fresh provide page will act as an enthusiastic affidavit that finance was gifted and never loaned with the borrower,» says Melissa Cohn, local vp of William Raveis Financial.

Appearing the income was a present

The new page needs to suggest that the fresh gifter are handing your the cash without presumption out-of fees – with no attract charged.

Mortgage brokers need that it, because using a loan to suit your down-payment is a big zero-no. Just would it not change the items of the funds – and that your own mortgage approval, this may potentially create more complicated on the best way to afford their month-to-month mortgage payments, also.

What things to use in a present letter

Mortgage current page conditions differ by loan particular, nevertheless the head bit of advice your lender is looking for are an announcement on the donor that money try a beneficial present and you commonly anticipated to pay off all of them. They want to make certain the funds you might be choosing commonly that loan, just like the that loan generally can’t be utilized for a deposit.

Your lender may provide you having a template out of what they want this new page to provide. This tends to include:

Mortgage gift page template

Prove together with your bank the information it entails your donor to include in their letter. In the event the donor writes the page, it should browse such as this:

I [donor label] hereby approve which i in the morning and work out a gift from $[current dollars amount] to [label out-of individual], who’s my personal [relationship to recipient]. Such provide fund have been moved to your [day regarding import].

So it current is to be used for the the acquisition of the possessions during the [target of the home getting purchased]. I certify you to payment from the present isnt asked otherwise meant. These types of current money were not provided to the donor of any individual or organization with an intention throughout the profit out-of the property (such as the provider, realtor otherwise broker, builder, financing manager, otherwise people organization associated with them).

Downpayment present laws and regulations believe the type of mortgage you might be playing with, but basically loved ones – eg parents, siblings, grand-parents, aunts, and you may uncles – have the ability to render deposit gifts. Most money wouldn’t create anyone with a monetary share throughout the transaction provide an advance payment present.

Lenders will need to be sure the reason of every high influx of cash during the financial closing techniques – even when it’s designated since the something special or considering for the cash. Nonetheless they must be reassured it is not a loan and will not replace your finances. And here the brand new current off collateral advance payment page arrives for the.

When someone are giving you a down-payment current, the borrowing from the bank ought not to amount. Somebody’s borrowing from the bank will impact your home mortgage for folks who include them just like the a great co-borrower or cosigner on the loan.

The financial ple down-payment present letter you can use for advice, you can also see credible templates on the web, as well.

A properly-created letter would be to improve your software, once the a bigger down-payment tend to reduce your loans-to-earnings proportion and lower your risk since a debtor.

Just like the recipient, you generally don’t need to value taxation outcomes when receiving current financing getting an advance payment, however may want to make sure that your donor knows that when they leave you a giant enough sum, they need certainly to report it into the Internal revenue service. Having 2024, the brand new yearly exclusion to own merchandise are $18,000. In the event the donor offers less than so it, they almost certainly don’t have to divulge their current.