When you are permitted use the hook-right up concessional benefits legislation, you’re able to carry forward one empty concessional efforts for 5 years. For people who surpass their concessional cap yet not, the excess efforts would be taxed at your marginal taxation price (tax rate you have to pay on your earnings).

Income tax to your extremely resource income

The first tax discounts are just a portion of the story. The brand new income tax into income for the very environment are low.

The earnings created by your $5k loans Bristow Cove very expenditures are taxed at an excellent limit rate from fifteen%, and qualified financing growth could be taxed as low as ten%, demonstrates to you Mills.

Once you retire and commence an income weight with your awesome savings, new money income is actually exempt off tax, as well as financing development. Existence spent can be a good, tax-efficient way to continue to make your finances do the job inside old age.

In addition to, when the time comes to gain access to the very inside the senior years, when you find yourself old 60 or higher, wide variety that you supply once the a lump sum are usually tax 100 % free.

However, it’s important to remember that shortly after efforts are designed to their extremely, it getting preserved’. Essentially, it indicates you can not accessibility these types of financing since a lump sum payment if you do not retire.

Upfront including most into the extremely, it is better to think about your broader financial specifications and exactly how far you really can afford to get out since the which have limited exclusions, you generally will not to able to view the cash in the extremely until you retire, says Mills.

Alternatively, of several mortgages shall be set-up to make you redraw the excess money you have made, or availableness brand new number regarding an offset membership.

For most people, repaying debt ‘s the top priority. Purchasing additional out of your house financing now wil dramatically reduce the month-to-month desire which help you pay from the loan in the course of time. In case the home loan enjoys an excellent redraw or offset facility, you might nonetheless availability the bucks in the event that some thing rating rigid later on.

Paying down your own home loan and you will typing later years debt-100 % free is quite enticing, claims Mills. It’s a life threatening fulfillment and you may means the conclusion a major ongoing bills.

Depending on your property loan’s proportions and you can title, desire paid back along the title of one’s mortgage will likely be significant such as, appeal toward good $500,000 mortgage over a twenty five-season label, at a level off six% turns out to get more than $460,000. Paying their home loan early plus frees up one future currency to many other uses.

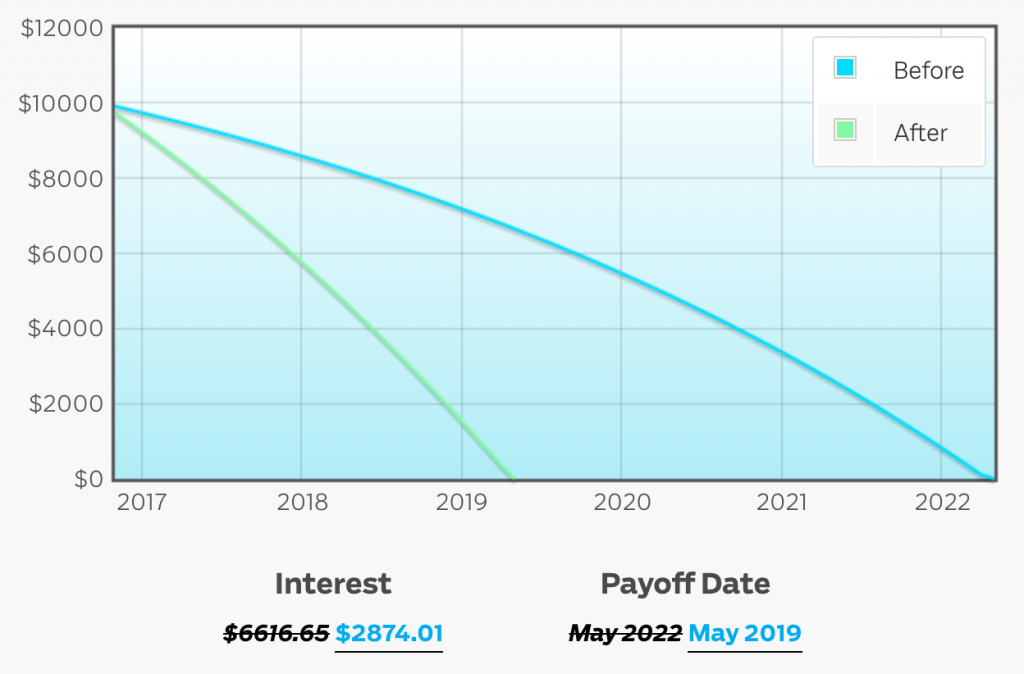

Reducing your financial ount interesting reduced along side duration of the mortgage and efficiently compatible money equal to brand new mortgage interest, teaches you Mills.

In advance and then make a lot more payments to your home loan, Mills suggests you really need to first consider any alternative non-allowable obligations you really have, for example playing cards and private funds.

Basically, these products keeps highest interest levels connected to them so there are better work with in lowering which obligations in the place of their reduced rate of interest financial.

Conclusion: home loan otherwise very

Its one of those discussions that scarcely seems to have a good clear-cut champion: must i pay back the loan otherwise lead extra back at my awesome?

There’s no one size suits every services when it comes to your best method to set up to have senior years, says Mills.

For the one hand, contributing a whole lot more to your awesome will get increase your final old age income. On the other side, and make additional home loan repayments can help you obvious your debt ultimately, improve your collateral reputation and set your on the road to financial liberty.

Whenever weighing in the pros and cons of every solution, Mills indicates there are some key points to store inside the attention.