Even though many dealers spend bucks for rent characteristics or home it intend to boost and you can flip, you really have several options for money a residential property. Here you will find the typical ones.

Antique money

It’s possible to be eligible for conventional funding to possess capital characteristics with as low as fifteen% off, otherwise an 85% loan-to-value ratio and you can at least credit rating out-of 680. You view web site could potentially finance a total of 10 characteristics all the way to four systems-the majority of your home and up to nine 2nd home otherwise resource properties-which have antique financial support, Stroud cards.

Just remember that , traditional fund has actually financing limitations and also you need certainly to qualify for for every single financing you sign up for, that will be challenging according to your debt-to-earnings ratio (DTI) and you may sum of money supplies.

Government-supported loans

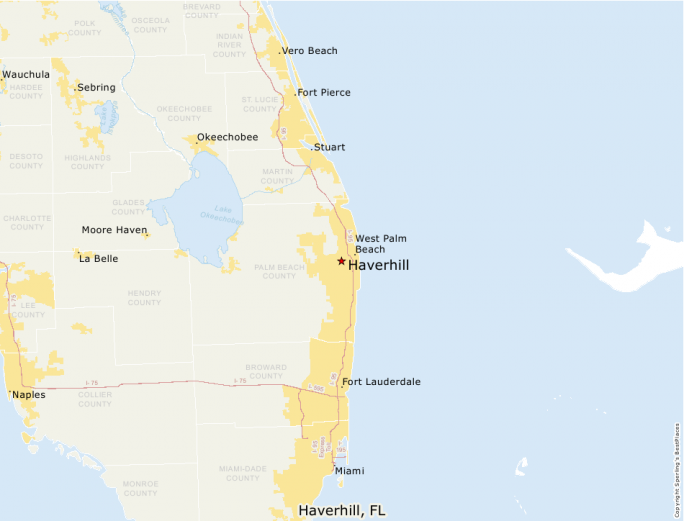

When you can’t play with government-backed funds purchasing an investment property outright, you can get a beneficial multifamily property (up to four equipment) since the an initial home, are now living in one equipment and you can book the others getting earnings. FHA funds has loan restrictions that differ considering where in new U.S. you may be purchasing the family; most Virtual assistant funds lack financing limits.

FHA financing need a minimum of 3.5% off (to have borrowers which have at the very least a great 580 credit score) and you may Virtual assistant loans wanted zero advance payment. The newest Va itself does not set minimum credit score criteria, but the majority of loan providers whom bring Va fund set it 620 otherwise higher-although some go as little as 580.

Non-QM fund

A non-certified financial (non-QM) financing is financing that doesn’t conform to government requirements to own a professional mortgage. Non-QM financing cost are typically higher than conventional mortgage pricing to have resource characteristics as they promote way more being qualified autonomy and you may larger mortgage number.

A well-known low-QM option for a home dealers is actually an obligations-services coverage proportion (DSCR) mortgage, which qualifies you according to research by the estimated cash flow accommodations assets builds. A familiar strategy for people would be to function a restricted responsibility providers for their expenditures, that provides taxation experts and you can handles its individual economic assets in the event the they standard for the money spent loan, Wade Mortgage’s Stroud teaches you.

For example, Deephaven Mortgage, hence lovers that have originators across the U.S. getting low-QM products, allows that loan-to-well worth ratio as high as 80% (or 20% down) and you may a maximum amount borrowed regarding $dos.5 billion into its DSCR money, considering Tom Davis, head conversion administrator that have Deephaven.

The lending company need three months of cash reserves having mortgage number from $1 million otherwise less, and half a year out-of supplies to own loan quantity a lot more than $one million.

Tough money financing

Hard money financing appear due to private people or personal organizations and frequently require equity, like property, to help you secure the mortgage. They often enjoys smaller cost terminology (but a few many years), highest down repayments and you may notably large cost than just traditional funding. not, you can generally speaking score these financing reduced in accordance with less obstacles than simply conventional mortgages.

It can be apparent, you will likely be sure you could pay off everything acquire before you take out such financial support.

Current home loan cost

Current home loan costs for investment features and you can top homes try trending all the way down because market cost throughout the high possibilities that Government Set-aside will cut their benchmark government finance rate on the slip.

Financial cost to possess financial support services is higher than first homes, in the event, because these attributes carry a top default exposure for those who slip trailing toward mortgage repayments as the home is bare otherwise an effective tenant falls behind with the lease.

Knowledgeable a property traders always buy even with industry volatility and you can highest interest levels, states Davis of Deephaven. Throughout times of high rates and family affordability demands, renting could be more sought after. A residential property people would be shorter concerned about the pace because this signifies a potentially more profitable chance.