Ridgeline Belongings, LLC, thinks finding guarantee and you can count on later on, and there is no better way showing optimism than simply strengthening your perfect house. All things considered, i its care about our very own customer’s road to looking or strengthening the dream domestic. We understand the latest anger of your credit process, so when your make your lookup, visitors mortgages commonly that-size-fits-all of the.

Build Finance

Instead of traditional funds, structure money pay money for the procedure of homebuilding. Furthermore, brand new recognition, appraisal, and you may disbursement procedure are different away from a classic mortgage. Including, the mortgage alone covers more than simply strengthening will set you back. For the majority finance, the newest house, work, arrangements and you will it permits, contingency supplies, and you may attention reserves all are within the mortgage package.

Spotting the difference

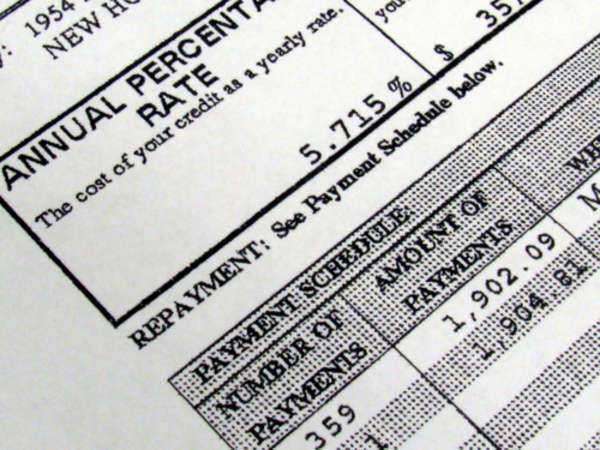

Earliest, you need to get your own borrowing from the bank in check. Really lenders wanted a score from 680 or even more. Along with, new https://clickcashadvance.com/installment-loans-il/oakland downpayment might be higher than a conventional mortgage. Lenders wanted a beneficial 20%-30% advance payment the construction mortgage. Framework finance are for a smaller identity as well as have highest focus rate home loan that covers the price of strengthening. Another way a casing loan differs, is the fact that the bank pays a construction mortgage into the contractorRidgeline Homeinto the payments while the construction stages come to specific milestones. As soon as your fantasy house is complete, the home design financing try possibly converted into a far more permanent mortgage, otherwise its paid in complete.

Two types of Money

- Construction-to-Permanent Mortgage (Single-Close)So it mortgage allows the new debtor getting rates secured within the at the time of closure, just like a traditional loan. Most frequently selected having residential household developers, this design loan kind of makes you transfer the construction away from your home with the a long-term home loan, and is also best suited for individuals who dont spend the money for entirety of financing adopting the build of the home.

- Construction Only (Two-Close)Can you propose to pay back the whole design will set you back off your property immediately following its over? Up coming it loan is for your! Yet not, so it mortgage does not come without its caveats: Not simply do you have to meet the requirements and now have acknowledged, however you may have to shell out settlement costs over and over again.

Old-fashioned Funds

Perhaps not prepared to help make your fantasy house? That’s okay! Ridgeline Residential property even offers the latest-structure house during the around three convenient, yet peaceful, urban centers in the Montrose, CO. If this is the fresh new route you intend to capture, then listed below are some biggest items into landing a traditional financingthe most used form of financing.

Spotting the real difference

Antique loans are the most effective brand of financing for individuals who has good credit, a constant money, and you can who’ll manage an advance payment. While it is far better set-out the fresh 20%, some loan providers assist buyers who can merely establish as little due to the fact 5% which have personal mortgage insurance (PMI).

When you find yourself conventional loans is the typical, they are not for everyone. What the results are if you don’t have great borrowing? Or what if you happen to be an experienced? Otherwise a primary-date homebuyer? If it pertains to your, then you’ll need search federally-backed loans like Virtual assistant, FHA, otherwise USDA. If you don’t, here you will find the 2 kinds of traditional financing:

- Fixed-Price Home loanIf you intend to stay in your property for around eight or higher ages, upcoming this really is a selection for your. Living of one’s financing usually is part of a beneficial 15 season deal, otherwise a 30 season package. More over, their monthly obligations are typically lowest, having he could be spread out over the years.

- Variable Rates Home loanThese types of home loan is geared toward people that do not thinking about staying in their house after dark day in the event that interest rate vary, in addition to terms are typically: three years, five years, 7 age, otherwise a decade. It’s called a varying speed financial since the there is a primary months in which their speed is restricted; although not, after this 1st period, the interest rate can be to alter (increase).

Buy Ridgeline House

Assist Ridgeline Land take you step-by-step through the procedure of investment their bespoke home. It is so effortless, you’ll have this new secrets to your brand-new domestic in no time. Step-by-action, we will help you through the solutions process of all of the phase of your own new housethroughout the interior, for the external, towards landscaping means! While doing so, you’ve got about three, silent subdivisions to choose from. We need to analyze you, and understand the version of lifetime we want to go.